What is a Voluntary Administration?

A Voluntary Administration (VA) exists to provide for the business, property and affairs of an insolvent company to be administered in a way that:

- maximises the chances of the company, or as much as possible of its business, continuing in existence

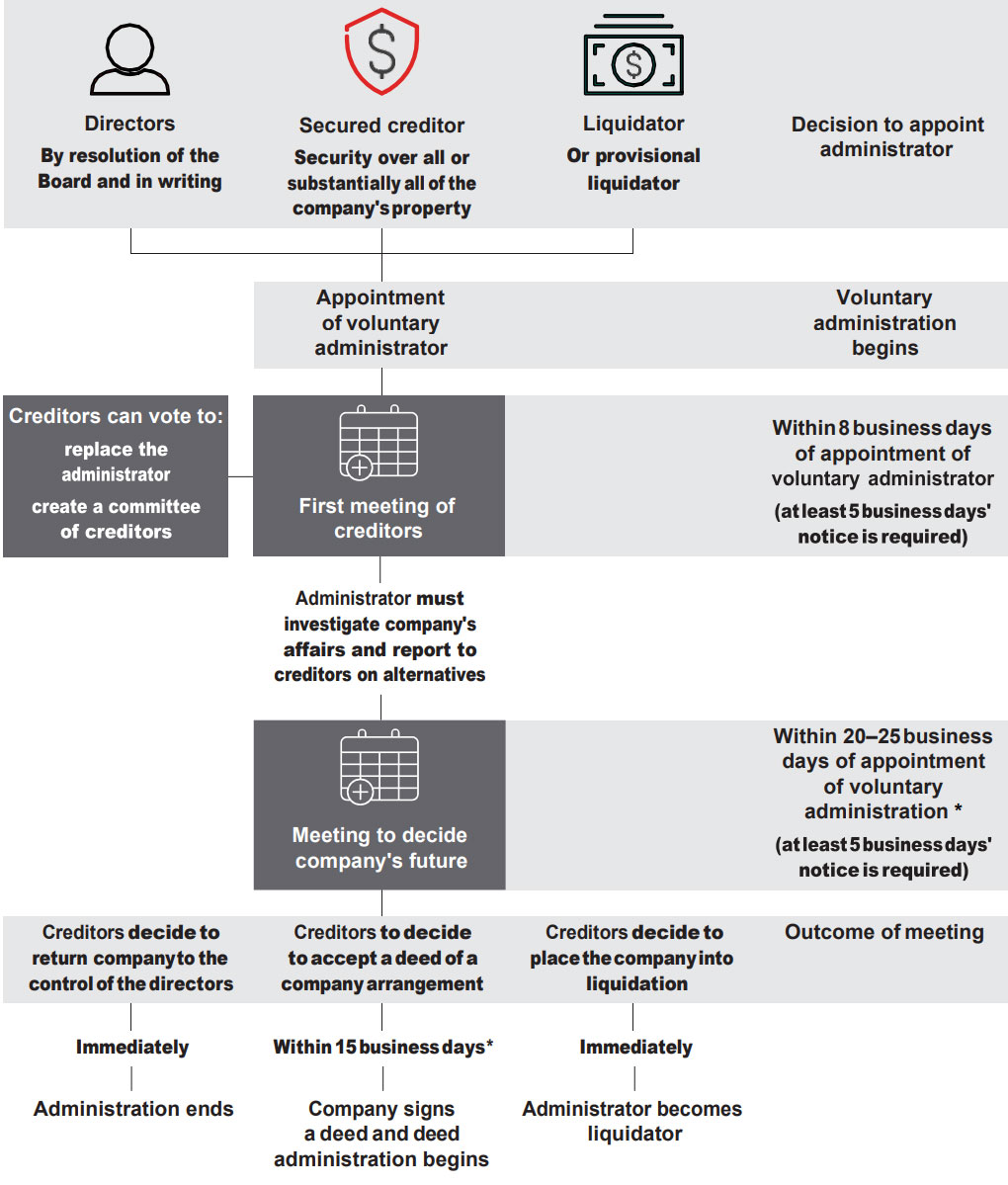

- if it is not possible for the company or its business to continue in existence, results in a better return for the company’s creditors and members than would result from an immediate winding up of the company VA is an insolvency procedure where a voluntary administrator (administrator) is appointed by:

- the company after its directors resolve that the company is insolvent or likely to become insolvent

- the company’s financier who holds a registered general security interest

- the company’s liquidator

What is the effect of a VA?

The effect of the VA is to provide the company with time and protection from creditors while the company’s future is resolved.

There is a stay of proceedings issued against the company and a restriction on owners and lessors recovering property used by the company. However, a creditor with a general security interest may enforce its security interest within 13 business days after receiving notice of the appointment (as required by the Corporations Act) or within 13 business days after the day the administration begins.

Will creditors be paid during the VA?

Creditors will not receive payment of unsecured claims during the VA as they are statutorily frozen. If there are sufficient funds available for creditors, dividends will be paid after the VA; during either the subsequent deed of company arrangement or liquidation.

Any debts that arise from the administrator purchasing goods or services, or hiring, leasing, using or occupying property, are paid from the available assets as costs of the VA. If there are insufficient funds available from asset realisations to pay these costs, the administrator is personally liable for the shortfall.

Who is in control of the company?

While a company is under administration, the administrator:

- has control of the company’s business, property and affairs

- may carry on that business and manage that property and those affairs

- may terminate or dispose of all or part of that business, and may dispose of any of that property

- may perform any function, and exercise any power, that the company or any of its officers could perform or exercise if the company were not under administration. The powers of other officers are suspended, except to the extent that the administrator has given written approval to the contrary.

What is the role of the administrator?

The role of the administrator is to investigate the company’s affairs, report to creditors and recommend to creditors whether the company should enter into a deed of company arrangement, go into liquidation or be returned to the directors.

Can an alternate administrator be appointed?

A creditor who wishes to nominate an alternative administrator must approach a registered liquidator before the meeting of creditors, with a written consent from an insolvency practitioner, stating that they would be prepared to act as administrator.

What Are The Steps Involved in a VA?

*Unless the Court allows an extension of time. Source: http://asic.gov.au/regulatory-resources/insolvency/insolvency-for-creditors/creditors-voluntaryadministration/

What information is given to creditors?

The administrator will notify creditors of the VA and convene the first meeting of creditors within three business days of the appointment.

The first creditors’ meeting is held within eight business days after the VA begins. The purpose of the first meeting is for creditors to decide two questions:

- whether they want to form a committee of inspection, and, if so, who will be on the committee

- whether they want the existing administrator to be removed and replaced by an administrator of their choice

At the second meeting, creditors are given the opportunity to decide the company’s future. This meeting is usually held about five weeks after the company goes into VA (six weeks at Christmas and Easter).

In preparation for the second meeting, the administrator must send creditors the following documents at least five business days before the meeting:

- a notice of meeting

- the administrator’s report on the business, property, affairs and financial circumstances of the company

- a statement about any proposals for a deed of company arrangement

Administrator’s report to creditors

The administrator is required to:

- report on the company’s business, property, affairs and financial circumstances

- provide a statement setting out the administrator’s opinion about the future of the company and reasons for those opinions

The administrator’s report should contain sufficient information to provide creditors with an understanding of:

- the history of the company and the reasons leading up to and the need for the appointment of an administrator

- the administrator’s prior involvement with the company

- the historic financial performance and position together with the current financial position of the company

- any offences, voidable transactions or insolvent trading claims

- the estimated return from winding up the affairs of the company

- any proposal for a Deed of Company Arrangement and the estimated return from same

- the administrator’s recommendation

- any other material information